Are Sales Commissions Manufacturing Overhead

Manufacturing Overhead Definition

Manufacturing overhead refers to the indirect costs incurred in the manufacturing of products. Information technology is assigned to every unit produced so that the toll of each production can arrive. Its examples include rent of the manufacturing building or premises, depreciation, utilities price incurred in manufacturing similar electricity, water, gas, oil repairs, maintenance costs incurred in production, insurance, etc.

Table of contents

- Manufacturing Overhead Definition

- Types of Manufacturing Overheads

- Examples of Manufacturing Overhead

- Example #1

- Example #two

- Advantages

- Disadvantages

- Decision

- Recommended Articles

- Manufacturing overhead refers to the unintended costs incurred during the product of products. For the toll of each product to be determined, information technology is assigned to every unit of measurement produced.

- There are ii types of manufacturing overheads, fixed and variable. Variable overheads depend on the number of units produced, such as electricity bills. Notwithstanding, fixed costs do not depend on the number of units produced; they remain the same. Examples include rent and depreciation.

- Manufacturing overheads are tax-deductible, and it helps to curtailed costs during inflation. However, it also has a few disadvantages, such as it requires a strong workforce that needs to be assigned to diverse manufacturing units, and this means that even when product isn't happening, the costs remain the aforementioned.

Types of Manufacturing Overheads

Yous are gratuitous to use this image on your website, templates, etc, Please provide the states with an attribution link Article Link to be Hyperlinked

For eg:

Source: Manufacturing Overhead (wallstreetmojo.com)

- Variable– It depends on the number of units produced. The cost will change if the number of units changes. Examples –sales commission Sales commission is a budgetary reward awarded by companies to the sales reps who have managed to attain their sales target. Information technology is an incentive geared towards producing more sales and rewarding the performers while simultaneously recognizing their efforts. A sales commission agreement is signed to agree on the terms and weather set up for eligibility to earn a committee. read more , electricity, water.

- Fixed– These costs practice not modify even when the number of units produced has inverse. Examples – include rent, depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. Its value indicates how much of an nugget'southward worth has been utilized. Depreciation enables companies to generate acquirement from their assets while only charging a fraction of the cost of the asset in use each yr. read more , insurance, property taxes.

The formula is represented every bit follows,

Manufacturing Overhead = Fixed Manufacturing Overhead + Variable Manufacturing Overhead / Number of Units Produced.

Manufacturing Overhead = Fixed Manufacturing Overhead + Variable Manufacturing Overhead / No. of Units Produced

You are complimentary to use this image on your website, templates, etc, Please provide united states of america with an attribution link Commodity Link to exist Hyperlinked

For eg:

Source: Manufacturing Overhead (wallstreetmojo.com)

Examples of Manufacturing Overhead

You lot can download this Manufacturing Overhead Excel Template here – Manufacturing Overhead Excel Template

Case #one

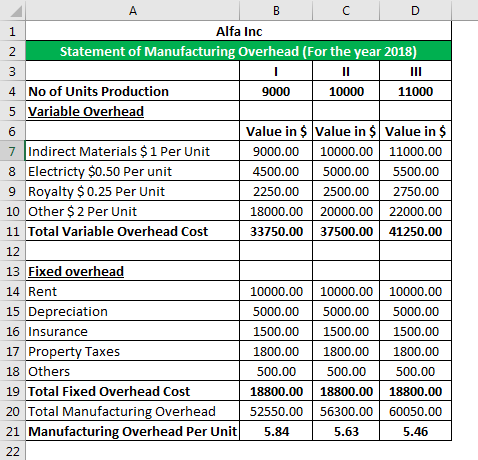

Below is the manufacturing overhead statement of Alfa Inc. for 2018, where the visitor has estimated overhead of 9000, 10000, and 11000 units. The company has some variables and some stock-still overhead in the information below. Variable overhead will depend on the number of units, whereas fixed overhead volition remain fixed irrespective of the number of units manufactured.

Below are the variable overhead expenses of the company

- Indirect Cloth cost = $1 per unit.

- Electricity Expenses = $0.50 per unit of measurement.

- Royalty Expenses = $0.25 per unit.

- Other Indirect Material Cost = $2 per unit.

Below are the fixed overhead expenses of the company

- Factory Rent = $10,000.

- Depreciation on Plant, Machinery, and Equipment = $5,000.

- Insurance for Manufacturing Activity = $1,500.

- Property Taxation = $i,800.

- Other Fixed Overhead Expenses = $500.

Adding of Manufacturing Overhead Manufacturing Overhead, also known as Manufacturing plant Overhead, refers to all the indirect factory-related costs incurred in the product manufacturing process. Yous can calculate it past adding up all the indirect expenses, including Depreciation charges, Mill Building Rent, Salaries of Manufacturing Managers & Material Managing Staff, Belongings Taxes, & Mill Utilities. read more for 9000 units of production

Similarly, we tin can calculate for 10000 and 11000 units of production.

In the above statement, the total variable toll of the company is $33,750 for 9000 units, $37,500 for 10000 units, and $41,250 for 11000 units, simply the totalstock-still cost Fixed Cost refers to the cost or expense that is not afflicted past any decrease or increase in the number of units produced or sold over a short-term horizon. It is the type of cost which is non dependent on the business activity. read more than is $18,800 for any number of units produced.

Example #2

Below is an example of manufacturing overhead for Mercedes-Benz Cars. In 2018, the company manufactured m units of Cars.

Below are the expenses incurred by the visitor.

- The company has purchased $500 million of material, of which $100 one thousand thousand is for indirect fabric.

- The total labor cost of the visitor was $350 million, of which $fifty meg is indirect labor.

- Power, fuel and electricity expenses incurred past the company were $lxxx million.

- The company's comprehensive insurance was $xx meg, of which $5 million was for other than manufacturing activeness.

- Depreciation of institute, machinery, and equipment was $5 million.

- Research & evolution expenses incurred of $five million.

- Selling & distribution expenses incurred $10 million.

- Repair & maintenance expenses of $15 million.

In the in a higher place examples, enquiry and development Inquiry and Evolution is an actual pre-planned investigation to gain new scientific or technical knowledge that tin be converted into a scheme or formulation for manufacturing/supply/trading, resulting in a concern reward. read more of $v million and sales & distribution expenses of $x 1000000 are unrelated to manufacturing activity. Therefore, these expenses are not considered in the manufacturing overhead of Mercedes-Benz.

Advantages

- Considering overhead as a office of the price of each product helps price the product effectively.

- Information technology is tax-deductible. A company should place all these costs as part of its manufacturing expenses because this will reduce the taxable income The taxable income formula calculates the total income taxable nether the income tax. It differs based on whether you are calculating the taxable income for an private or a business organisation corporation. read more and lower the tax burden.

- It helps to control the cost in the inflationary marketplace by controlling the manufacturing toll. Failure to control overhead costs could increase the product cost.

- Assigning the overhead with products allows management to meliorate plan, upkeep, and price products.

Disadvantages

- It requires a workforce to assign the manufacturing unit to every product unit.

- Stock-still manufacturing costs will continue even if there is no production. It means the company has to aggrandize without any manufacturing activity, affecting its Cash Flow is the corporeality of cash or greenbacks equivalent generated & consumed past a Company over a given period. It proves to exist a prerequisite for analyzing the business'southward strength, profitability, & scope for betterment. read more than cash flow Cash Flow is the amount of cash or cash equivalent generated & consumed by a Visitor over a given period. It proves to be a prerequisite for analyzing the business's force, profitability, & scope for edification. read more and profitability Profitability refers to a company's ability to generate acquirement and maximize profit above its expenditure and operational costs. It is measured using specific ratios such as gross profit margin, EBITDA, and cyberspace profit margin. It aids investors in analyzing the visitor's performance. read more .

Conclusion

Manufacturing overhead costs are those costs that are directly non traceable, which ways allindirect cost Indirect price is the cost that cannot be directly attributed to the production. These are the necessary expenditures and can be fixed or variable in nature like the function expenses, administration, sales promotion expense, etc. read more related to manufacturing activity. It does not include expenses incurred in the period, but information technology has to be added to the cost of the product.

Frequently Asked Questions (FAQs)

Why is manufacturing overhead so of import?

Manufacturing expenses shed light on the company's character. For instance, if a business hires many individuals for quality assurance or quality command, this suggests they have a good mental attitude toward their piece of work. Keeping the rubber of the production unit in mind.

What is non included in the manufacturing overheads?

The manufacturing overhead does not include all marketing and direction activities. Every bit a result, expenses related to corporate salaries, legal and audit fees, and bad debts are excluded from production overhead.

What are the steps involved in the calculation of manufacturing overhead?

Here are the 3 steps involved in the calculation of manufacturing overhead:

Recording the bodily costs.

Apportioning the cost part to a manufacturing overhead account.

Allocating the overhead to work in the process account.

Recommended Articles

This has been a guide to what Manufacturing Overhead is and its definition. Here we discuss the types of manufacturing overhead forth with examples, advantages, and disadvantages. You lot tin can learn more nigh finance from the following manufactures –

- Unit of Production Depreciation

- Overhead Costs Calculation

- Semi Variable Cost Calculation

- Formula of Predetermined Overhead Charge per unit

Are Sales Commissions Manufacturing Overhead,

Source: https://www.wallstreetmojo.com/manufacturing-overhead/

Posted by: pricewhave1982.blogspot.com

0 Response to "Are Sales Commissions Manufacturing Overhead"

Post a Comment